We feel investors should have an information outlet for the financial markets that is thorough, but does not require a prerequisite degree in economics. We hope this makes our commentary informative and educational for all levels of investors.

Quarter in Review

| Asset Class† | 2nd Quarter 2018 Return | Past 12 Months |

| U.S. Small Cap Stocks | 7.8% | 17.6% |

| U.S. Large Cap Stocks | 3.4% | 14.4% |

| Commodities | 0.4% | 7.4% |

| U.S. Bonds | -0.2% | -0.4% |

| International Stocks | -2.6% | 7.3% |

The second quarter of 2018 was a reversal from the beginning of the year, as domestic stocks bounced back from negative returns and were also less volatile. The story is largely the same for bonds. While interest rates still rose over the course of the quarter, they leveled out considerably, resulting in a much smaller decline in their overall return (bond prices move inversely with interest rates).

As the U.S. economy continues to chug along, investors continue to keep an eye on the Federal Reserve’s future policy moves to ensure that the economy does not overheat. The two biggest factors in gauging their moves are the employment numbers and inflation. Usually, investors look for a combination of low unemployment and increasing inflation to predict a change from the Fed. The unemployment rate continued to fall during the second quarter, reaching 3.8% in May, which is the lowest point since 2000, while inflation which had been accelerating higher in past quarters has leveled out. Such a combination has many thinking we are in a “goldilocks” period where the economy isn’t too hot nor too cold, meaning the Fed won’t make any significant changes to the expectations of 1 or 2 more rate increases in 2018. Workers’ earnings are one measure that is a bit confounding. While inflation of the prices of goods and services have been increasing, wage growth for workers has not been keeping pace.

While overall inflation has been more subdued in the most recent months, consumers are starting to feel a little more pain at the pump as oil prices have reached their highest level since late 2014, right before the U.S. “fracking” boom.

In the Headlines: Free Trade

This quarter marked a significant shift in U.S. approach to trade policy. After decades of moves by the U.S. to further free trade with other countries, the Trump administration has made a point to expose what they perceive as unfair practices that hurt domestic businesses by implementing tariffs, most notably to China, the largest trading partner with the U.S. This change and the resulting effects to consumers is worth a deeper look.

History of U.S. and free trade

A history of American free trade deserves a space much larger than a single paragraph, but there are a few significant factors that have led to the U.S. embrace of free trade policy, namely globalization and shifts in employment trends. In the last half-century the U.S. has also evolved from a largely industrial and agrarian economy to a service based economy, where in the simplest terms, we are purchasers (importers) of goods and sellers (exporters) of human capital or ideas. With advancements in transportation and technology, it has become increasingly easier and cheaper for wealthy countries to outsource much of their goods and agriculture to regions outside of their own borders.

How things have changed

The U.S. consumer has been a significant beneficiary of free trade practices as Americans are able to buy goods that require a less-skilled workforce at much cheaper prices than they would if they were produced state-side. Much of the backlash to free trade in recent years has focused on working conditions and sweatshops, a belief that yes, the U.S. consumer benefits, but at the detriment to workers in a far-away land.

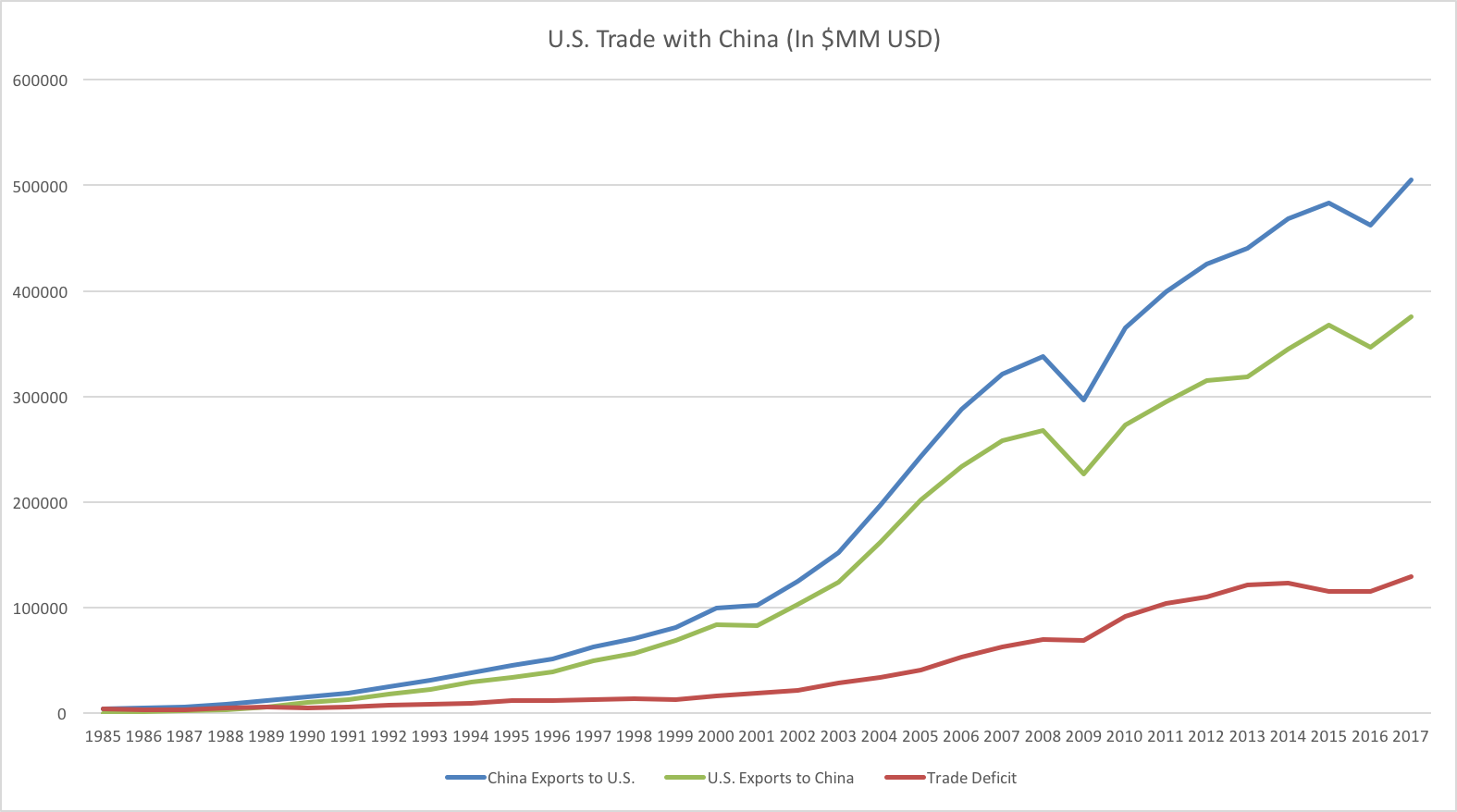

The Trump administration however views our reliance on trade, especially with China, in a much different light. Since 1985, the trade deficit between the two countries has continued to grow and the expanding gap, says the Trump administration, is having adverse effects on the U.S. economy, namely job losses in manufacturing and infringement on U.S. intellectual property.

Source: US Census Bureau

While China’s stronghold on manufacturing is reducing the number of jobs in U.S. and disrupting the workforce, many economists view this as a temporary issue, as any job losses in manufacturing will be shifted to other industries. This is little solace to U.S. manufacturing workers, especially those in the late part of their careers where learning new skills is increasingly difficult. Erecting stronger trade barriers, says the Trump administration, will save many of those jobs as companies will find it cheaper to produce some goods in the U.S.

There is also the perception that China’s trade practices are harmful to the intellectual property rights of U.S. companies. As China has become an advanced economic powerhouse, they have become increasingly proficient in producing more advanced goods–especially relating to technology. This advancement has put a spotlight on China’s weak intellectual property laws, which have little respect for design secrets that are protected by U.S. courts.

A specific example of this involves the F-35 fighter jet made by U.S. company Lockheed Martin. In 1999 Chinese hackers were able to steal design secrets from Lockheed and a government-owned defense company has since created a similar jet, the J-31, which is believed to be a “knock-off” of the F-35 jet. Such practices are highly illegal in the U.S., but fall in to a much more gray area in China. The Trump administration believes the tactics used in the reproduction of the F-35 as the J-31 are the tip of the iceberg for future infringement of U.S. goods.

What this means

There are truths to all sides of this issue. Free trade with countries like China has been incredibly beneficial to the U.S., but the concerns outlined by the Trump administration are also valid. In the short term, the tariffs will likely have only slight repercussions on the U.S. consumer, especially if they are short-term in nature and have the intended effect of making China rethink many of its current practices that harm U.S. companies. However, if this mindset of creating a more level playing field continues for months or years, the effects could be significant in the form of higher inflation, lower profits for companies and a reduction of the U.S’s sway in the global stage. At this point it is hard to determine whether Trump’s bet on China acquiescing will pay off, but it is certainly a disruption of the status quo, something that Trump has found to be his calling card.

IMPORTANT INFORMATION

The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes and represents Wilson Capital’s views based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Wilson Capital is a Registered Investment Advisor (“RIA”), registered in the state of Massachusetts. Wilson Capital provides asset management and related services for clients nationally. Wilson Capital will file and maintain all applicable licenses as required by the state securities boards and/or the Securities and Exchange Commission (“SEC”), as applicable. Wilson Capital renders individualized responses to persons in a particular state only after complying with the state’s regulatory requirements, or pursuant to an applicable state exemption or exclusion.

Click here to download a PDF of this Investment Letter 2Q18-Investment-Letter-Final-72318.pdf (9967 downloads )

Comments are closed