As an investment advisor, we feel investors should have an information outlet for the financial markets that is thorough, but does not require a prerequisite degree in economics. Thus we have included a glossary of terms at the end of this commentary. Each term with an asterisk has a corresponding definition in the glossary. We hope this makes our commentary informative and educational for all levels of investors.

2014 was a mixed bag for returns across many different asset classes. The U.S. large-cap stocks, as judged by the S&P 500, had another stellar year making it the 6th year in a row of positive returns. Interest rates swiftly reversed their upward trend as the page turned to 2014, which contributed to a better than anticipated year for bonds. Commodities continued their losing streak to a fourth year as the massive decline in oil prices played a significant role in weak returns.

| Asset Class† | 2014 Annual Return |

| U.S. Large Cap Stocks | 13.7% |

| U.S. Small Cap Stocks | 4.9% |

| International Stocks | -3.9% |

| U.S. Bonds | 6.0% |

| Commodities | -17.0% |

Quarter in Review

As we noted in our 3Q letter, the 4th quarter started with increased volatility as the markets were spooked by the possibility of an Ebola outbreak and heightened instability in the Middle East. As both issues subsided in late October, the stock market rebounded to new record highs as the year came to a close.

The undercurrent of the market during the 4th quarter was the aforementioned decline in the price of oil. The decline was big enough to push gasoline prices to their lowest levels since 2009, essentially giving the American public a tax cut just before the holiday season. While worries of persistently low wage growth* still plagues workers, the lower gas prices could have a stimulating effect on the economy as it adds more money to consumers’ pockets.

Lower gasoline prices are projected to play a role in holding down the already low inflation rates (1.3% as of November) in the U.S. and abroad. Since the Federal Reserve has signaled that both low unemployment (5-6%)and higher inflation (2%) need to be present in order to raise interest rates, bond yields dropped to their lowest levels in nearly 2 years as 2014 came to a close.

Outlook

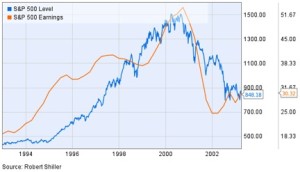

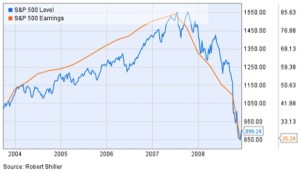

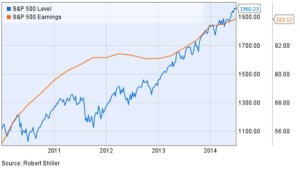

The current bull market is headed into its 6th year, leaving many talking heads to question whether the market has grown too long in the tooth — a term thrown around in these times is whether the market is “overvalued”. “Valuedness” is normally tied to the earnings of the companies that make up the market. As company earnings rise and fall so do their stock price. However, earnings and prices do not always rise in lock step, in fact they rarely do. In the current and two most recent bull markets (late 90s and mid 00s) earnings have outpaced prices early, but price eventually caught up to the trends set by earnings.

Late 90’s Bull Market and Dot Com Bubble Collapse

(Click to Expand Image)

Mid 00’s Bull Market and Financial Crisis of 2008

(Click to Expand Image)

The point where the price outpaces earnings has spelled trouble for the past two bull markets. Today we find the markets approaching that same precarious point where the growth of price and earnings cross.

Current Bull Market

(Click to Expand Image)

This scenario doesn’t necessarily mean a bear market is in the works, but does raise concern that the consecutive years of positive returns might be hitting a hiccup.

Glossary

*Wage Growth – Wage data is compiled by the Bureau of Labor Statistics and disseminated in its monthly employment situation usually on the first Friday of each month

† Indices used to represent asset classes:

U.S. Large Cap Stocks – S&P 500

U.S. Small Cap Stocks – Russell 2000

International Stocks – MSCI ACWI ex-U.S.

U.S. Bonds – Barclays Aggregate

Commodities – Bloomberg Commodity

IMPORTANT INFORMATION

The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes and represents Wilson Capital’s views based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Wilson Capital is a Registered Investment Advisor (“RIA”), registered in the state of Massachusetts. Wilson Capital provides asset management and related services for clients nationally. Wilson Capital will file and maintain all applicable licenses as required by the state securities boards and/or the Securities and Exchange Commission (“SEC”), as applicable. Wilson Capital renders individualized responses to persons in a particular state only after complying with the state’s regulatory requirements, or pursuant to an applicable state exemption or exclusion.

Click below to download a printable version of our 2014 4Q Investment Letter:

Wilson-Capital-4Q-2014-Investment-Letter.pdf (6612 downloads )

Comments are closed